Indonesia Real Estate Development sector is on the brink of a major transformation. With rapid urbanization, rising incomes, and strong government initiatives, the country is becoming a hotbed for real estate opportunities. From bustling cities like Jakarta to growing metropolitan areas, demand for residential and commercial properties is surging. Foreign investors are also taking notice, drawn by the potential for high returns and the country’s economic growth. Whether you’re an investor or developer, Indonesia’s real estate market offers exciting prospects that are hard to ignore.

Market Growth Projections

Indonesia’s residential real estate market is expected to expand from USD 72.11 billion in 2024 to USD 105.73 billion by 2029, growing at a compound annual growth rate (CAGR) of 7.95%. This substantial growth is fueled by increasing incomes, a rising middle class, and a large population of first-time homebuyers. The country’s construction industry is also benefiting from infrastructure development and economic growth, making it a hotspot for real estate development.

Impact of Urbanization in Indonesia Real Estate Development

Urbanization is one of the key drivers behind the increasing demand for real estate in Indonesia. By 2035, around 56% of Indonesia’s population is expected to live in urban areas. This shift is creating a high demand for housing in cities, particularly in major hubs like Jakarta and Surabaya.

Urban areas are experiencing a rise in high-rise buildings, condominiums, and apartments. The growing demand for housing options in these areas represents a lucrative opportunity for developers and investors looking to capitalize on this trend.

Rise of Foreign Investments

Indonesia Real Estate Development and market have attracted the attention of foreign investors in recent years. Countries like China have shown increasing interest, largely thanks to the government’s efforts to promote Foreign Direct Investment (FDI). In 2021, foreign investments accounted for approximately 15% of the total investments in Indonesia’s real estate sector. This reflects the confidence international investors have in Indonesia’s economic stability and growth potential. By simplifying regulations and providing incentives, the Indonesian government is actively encouraging foreign involvement in its real estate market.

Government’s “One Million Houses” Initiative

In response to the growing housing demand, the Indonesian government launched the “One Million Houses” program. The goal is to build at least 1 million housing units annually to address the country’s housing shortage. As of August 2023, more than 634,132 units had been constructed under this program, demonstrating progress toward providing affordable housing for Indonesians. This initiative not only aims to reduce the housing backlog but also creates opportunities for real estate developers to engage in projects that align with national housing needs.

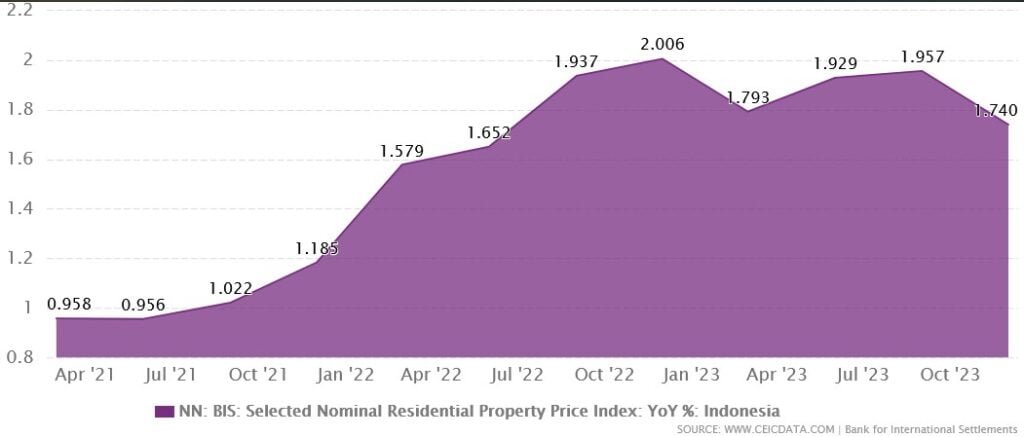

Rising Property Prices in Indonesia Real Estate Development

The strong demand for housing, particularly in major cities, has led to an increase in property prices. In Jakarta, for example, the average price for landed residential properties has reached over 15 million Indonesian rupiah per square meter (approximately USD 1,000). This rise reflects the growing purchasing power of Indonesians and a strong real estate market, making it an attractive option for both local and international investors.

Jakarta’s average rental rates are lower than those in Bangkok and Manila, making it an attractive option for budget-conscious renters. The occupancy rate in Jakarta shows positive recovery trends at 60.5%, while other cities like Singapore maintain much higher rates. For developers, this also signals the potential for healthy returns on investment, especially in prime urban areas where demand continues to soar.

Looking at the points above, Indonesia Real Estate Development landscape is evolving rapidly. This is driven by urbanization, increasing foreign investments, and supportive government policies. The projected growth of the residential real estate market, combined with rising property prices and a booming population, creates a promising environment for real estate developers and investors alike. As the country continues to develop its infrastructure and address its housing shortage, the opportunities in Indonesia’s real estate sector are bound to increase.