The Indonesia construction sector analysis shows a market in recovery—and on the rise. In 2023, the construction market is projected to reach IDR 332.95 trillion. This marks a strong rebound after the pandemic years. Civil projects make up 47.29% of the total, while building projects take a slightly larger share at 52.71%. The industry isn’t just growing in size—it’s growing in importance. In 2023, construction contributed 9.86% to the national GDP, making it one of Indonesia’s top economic drivers. Here's the inside story.

Recovery and Resilience: Indonesia Construction Sector Analysis

The construction industry’s journey through the pandemic has been one of both challenge and adaptation. After contracting by 4.5% in 2020 at the height of COVID-19 disruptions, the sector rebounded with 5% GDP growth in 2023.

However, not all numbers are up. The number of construction companies dropped slightly in 2022, down 3.13% to 197,030 firms. Many small and medium enterprises struggled to survive during the pandemic, but encouragingly, 2023 has brought renewed optimism, with new business registrations increasing by 12% year-on-year as confidence returns to the market.

Investments Fueling the Future

In 2023, the construction sector attracted USD 58 billion in investments, a clear sign of confidence. The road transport sector led with USD 26 billion, followed closely by energy projects at USD 22 billion. These two areas alone show where the future of infrastructure lies: better roads, and cleaner energy.

The government has also stepped up. The 2023 infrastructure budget hit IDR 392 trillion, up 7.75% from the previous year. This spending is not just on big-ticket projects. It supports everything from regional road upgrades to public utilities and urban planning.

Read Also: The Next Indonesia Infrastructure Investment Opportunities

Looking Ahead: Big Numbers, Bigger Potential

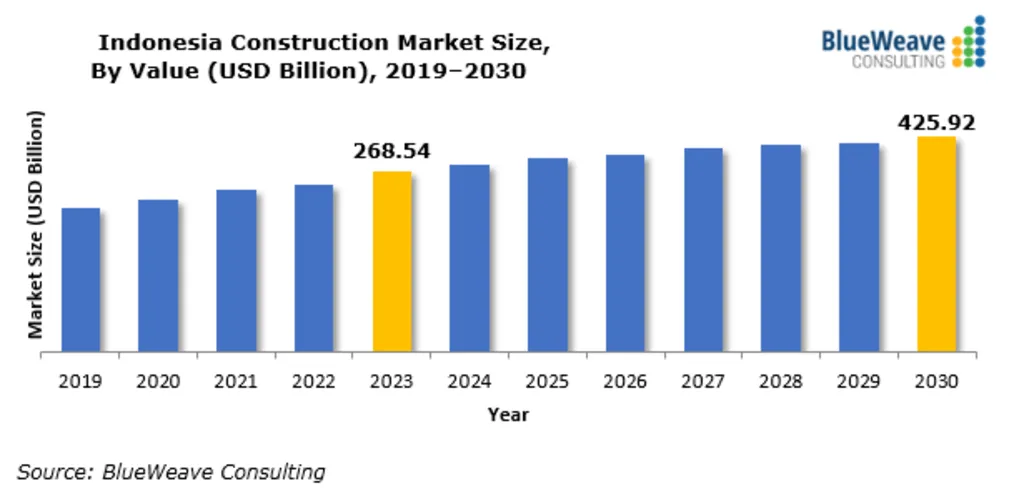

Industry forecasts paint an optimistic picture for Indonesia’s construction sector, with the market expected to reach USD 305.48 billion by 2025 before potentially climbing to USD 438.56 billion by 2030. This represents a compound annual growth rate of 7.5%. Several powerful demographic and economic trends underpin these projections.

Rapid urbanization will see 70% of Indonesia’s population living in cities by 2030, creating demand for approximately 2.5 million new housing units annually. Industrial expansion is driving construction of factories, logistics parks, and special economic zones in locations like Batam and Kendal. Meanwhile, tourism infrastructure development continues apace, with showcase projects including Bali’s Mandalika integrated resort and upgrades to Labuan Bajo’s visitor facilities.

Read Also: The Struggle of Indonesia Affordable Housing Challenges

Challenges Behind Indonesia Construction Sector Analysis and Growth

Despite positive numbers, regulatory hurdles remain. Many projects face delays due to complex permitting processes and overlapping government regulations. These issues can stall momentum, especially for new market entrants and smaller developers.

Another issue is the heavy role of foreign contractors, who now handle 74% of projects by value. While this brings new skills and technology, it also raises questions about the long-term development of local expertise.

Indonesia Construction Sector Analysis: A Sector to Watch

The Indonesia construction sector analysis reveals an industry rebounding with vigor—but long-term success hinges on overcoming structural challenges. If policymakers and businesses can cut red tape, upskill workers, and balance foreign/local participation, the sector won’t just grow—it will reshape Indonesia’s infrastructure landscape for decades. From the new capital Nusantara to rural road networks, construction is more than concrete and steel—it’s the foundation of Indonesia’s Vision 2045 economic ambitions.