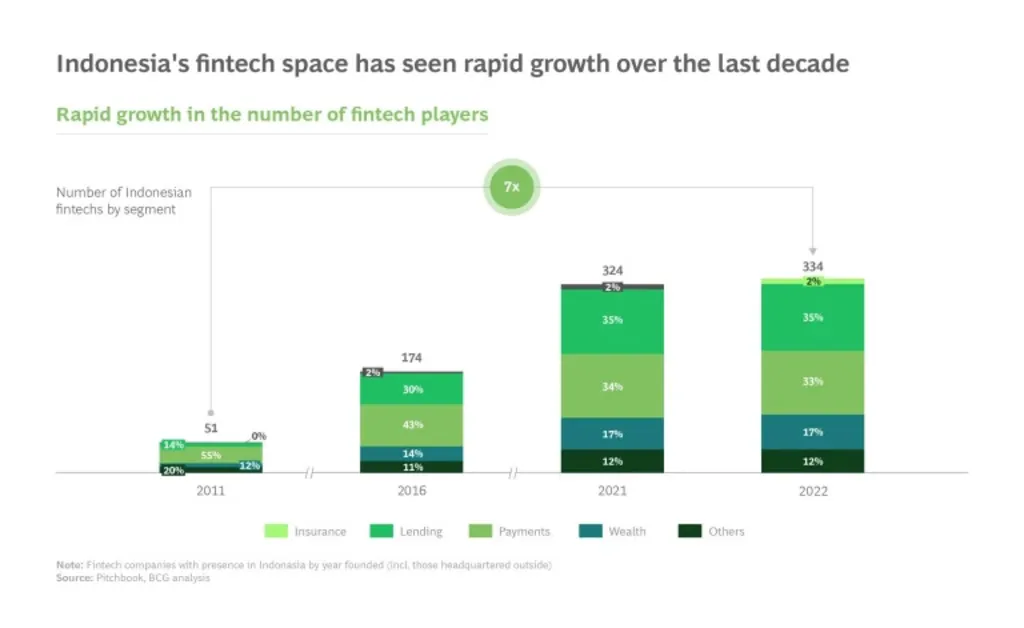

Indonesia’s fintech sector has grown at an extraordinary pace. In 2011, the country had just 51 fintech companies. By 2022, that number had reached 334, marking a six-fold increase in just over a decade. This rapid rise signals not just growth but a full-scale transformation of how financial services are delivered and consumed in the country. What began with a strong focus on digital payments has now expanded into lending, insurtech, wealthtech, and fintech SaaS. New players are emerging with fresh solutions tailored to consumers, businesses, and underserved communities. The scale and diversity of these offerings point to a maturing Indonesia fintech ecosystem expansion that is increasingly vital to the country’s financial future.

Indonesia Fintech Ecosystem Expansion: Rapid Adoption and Market Growth

Much of this growth has been fueled by the surge in digital payment adoption. Today, over 60 million Indonesians actively use digital payment platforms. From 2020 to 2025, the payment segment is expected to grow at an impressive 26% annually. Popular platforms like GoPay, OVO, and Dana have become household names, with features like QR code scanning and AI-based personalization making digital transactions easy and appealing.

This digital shift is mirrored by the rise of e-wallet transactions, which reached over US$20 billion between 2017 and 2021, growing at a 123% compound annual growth rate. The trend shows no signs of slowing, and fintech players are constantly refining their offerings to keep up with user expectations.

Read Also: Digital Wallets & Indonesia Digital Payment Adoption Explained

Driving Financial Inclusion Through Innovation

A key outcome of this expansion is improved financial inclusion. In a country where millions remain unbanked or underbanked, fintech provides new paths to credit and services. As of 2024, more than 30 million active peer-to-peer (P2P) borrower accounts have been recorded, offering financing to individuals and businesses that traditional banks often overlook.

Fintech has also empowered micro, small, and medium-sized enterprises (MSMEs), which make up over 97% of Indonesia’s businesses. Through fintech SaaS platforms, six million SMEs now manage operations, finances, and transactions digitally, and that's a 26-fold increase in just three years.

Read Also: The Growth of Indonesia Digital Banking Expansion

Investor Confidence and Capital Inflow in Indonesia Fintech Ecosystem Expansion

This transformation hasn’t gone unnoticed by investors. From 2020 to 2022, Indonesia’s fintech sector attracted US$3.2 billion in funding, 4.6 times more than the total investment between 2017 and 2019. In 2024 alone, fintech startups secured US$459.5 million across 28 deals, accounting for 41.8% of all startup investments in the country.

This surge in funding highlights not only the sector’s resilience but also the belief in its long-term impact on both the economy and society.

Indonesia Fintech Ecosystem Expansion: A Digital Finance Movement with Momentum

The Indonesia fintech ecosystem expansion is more than just a trend, but also xa movement reshaping access, equity, and efficiency in financial services. With soaring user adoption, record investments, and meaningful support for underserved communities, fintech in Indonesia is proving it can deliver growth with impact. As the market matures and digital finance becomes the norm, Indonesia’s fintech landscape is set to play a central role in building a more inclusive, empowered, and innovative economy.