Indonesia is taking bold steps to strengthen its economy and support key sectors through strategic monetary measures. At the heart of this effort is Indonesia Central Bank Liquidity expansion, a policy approach designed to fuel credit growth and promote economic resilience.

Strengthening the Banking Sector Through Indonesia Central Bank Liquidity Expansion

As of January 2025, Indonesia’s broad money supply (M2) stood at Rp9,232.8 trillion, growing 5.9% year-on-year—up from 4.8% the month before. This expansion reflects strong growth in narrow money (M1), which rose 7.2%, and quasi-money, which increased 2.2%.

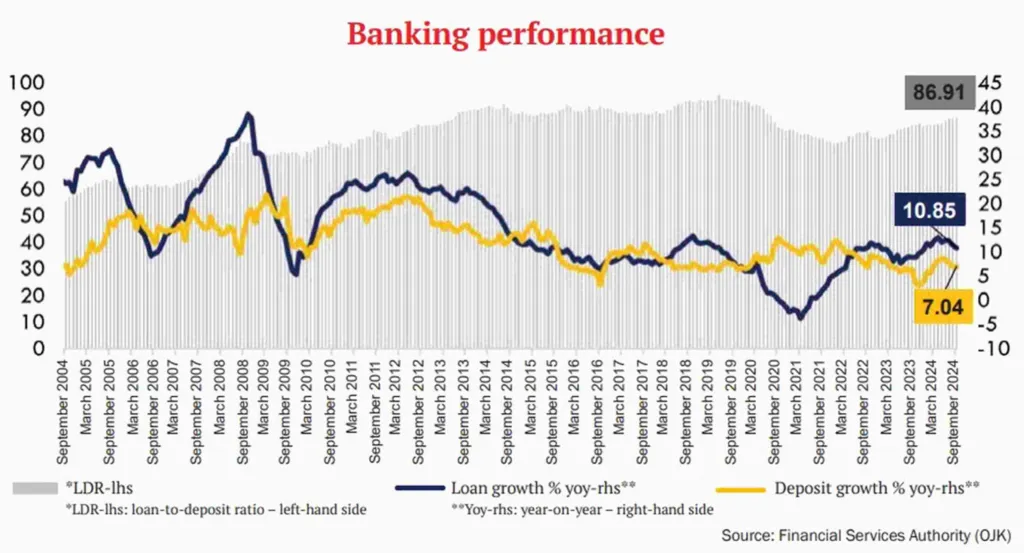

Alongside this, the country’s banking sector remains robust. Banks reported a solid loan growth of 10.27% year-on-year in January 2025, with investment loans growing even faster at 13.22%. This growth is supported by a high Capital Adequacy Ratio (CAR) of 27.05%, which is well above global minimum standards, and a healthy Loan to Deposit Ratio (LDR) of 87.64%. Non-Performing Loans (NPLs) are contained at just 2.18%, indicating sound credit quality and strong risk management.

Read Also: Why Indonesia Interest Rate Pause Signals Strength & Resilient

These numbers underline the sector’s readiness to absorb additional Indonesia Central Bank Liquidity and channel it toward productive lending activities.

Targeted Indonesia Central Bank Liquidity Incentives for Key Sectors

Bank Indonesia (BI) plans to increase liquidity incentives from Rp259 trillion to Rp283 trillion starting January 2025. The funds will target labor-intensive and strategic sectors such as agriculture, manufacturing, trade, and notably, housing.

Furthermore, BI distributed Macroprudential Liquidity Policy (KLM) incentives totaling Rp295 trillion (about $19 billion) by mid-January 2025. This amount rose by Rp36 trillion compared to October 2024. These incentives are focused on priority sectors, including micro, small, and medium enterprises (MSMEs), the green economy, and real estate.

Indonesia Central Bank Liquidity is also set to provide direct support to hundreds of banks across the country, totaling approximately IDR 290 trillion (around $19 billion) in 2025. This represents a 15.54% increase from the previous year, reinforcing BI’s commitment to widespread economic support.

Boosting Housing Projects and Creating Jobs

The housing sector stands out as a major focus of the nation's central bank liquidity support. By directing funds toward real estate and housing projects, BI aims to stimulate job creation and improve access to affordable housing.

During this period, BI’s decision to cut the benchmark interest rate by 25 basis points to 5.75% in January 2025 further supports borrowing and investment. Should inflation remain stable, analysts predict further reductions, potentially reaching 5.25% by the end of the year. Lower borrowing costs will make credit more accessible to businesses and households, helping drive economic momentum.

Read Also: Indonesia Education Sector Reforms Fuel Workforce Goals

Building a Resilient and Inclusive Economy

Indonesia’s liquidity measures are more than just financial injections. Actually, they represent a strategic effort to build a resilient and inclusive economy. The combination of strong banking fundamentals, targeted liquidity support, and accommodative monetary policy highlights BI’s proactive stance.

The impressive growth in broad money supply and robust credit expansion reflect the effectiveness of the liquidity policies in supporting economic activities. By focusing on sectors like housing and MSMEs, BI is ensuring that liquidity flows directly into areas that generate employment and improve living standards.

Indonesia Central Bank Liquidity: Ahead

In summary, Indonesia Central Bank Liquidity initiatives signal a clear commitment to economic growth and stability. With a solid banking foundation, strategic sectoral support, and forward-looking interest rate policies, Indonesia is well-positioned to strengthen its economic resilience and achieve inclusive development in the years ahead.