Indonesia has pledged to cut greenhouse gas emissions by 31.9% unconditionally and 43.2% with international support by 2030. To achieve these goals, the country must massively scale up Indonesia Green Energy Investment. Indonesia requires around $285 billion in green energy funding by 2030 but currently faces a $146 billion shortfall, highlighting the urgent need for private sector participation. In 2023, investment in renewable energy reached $1.48 billion, but by mid-2024, only $565 million had been invested. In contrast, fossil fuel sectors like mineral and coal attracted $2.4 billion in the same period, underscoring a stark imbalance.

Solar PV: Central to Indonesia’s Climate Strategy

Indonesia's total renewable energy potential is more than 3,686GW, with 3,295GW coming from solar. Yet, less than 13MW of solar PV has been installed. The government plans to change that. Its national power plan (RUPTL) sets a target of 17GW of solar capacity by 2034, aiming for 113GW by 2050.

Rooftop solar is gaining ground. From just 1.6MW in 2018, capacity jumped to nearly 49MW by 2021. Long-term projections show rooftop potential between 194GWp and 655GWp, with the capacity to generate up to 930.7TWh/year.

Read Also: How Indonesia Floating Solar Projects Redefine Clean Energy

Indonesia Green Energy Investment: Price Competitiveness and Policy Support

Solar PV is becoming cost-effective. Utility-scale projects now report prices below 4 cents USD/kWh, making them competitive with fossil-based generation. To support this momentum, the government offers incentives:

- 30% net income reduction for six years.

- Tax holidays and VAT/import duty exemptions.

- Feed-in tariffs and improved net metering under Regulation 26/2021.

PLN (Perusahaan Listrik Negara), the state-owned electricity company, is also aligning its procurement process with generation costs and preparing new tenders to boost project development.

Read Also: Pushing Indonesia Green Hydrogen Investment's Global Bet

Geothermal and Hydropower: Untapped Potential for Baseload Power

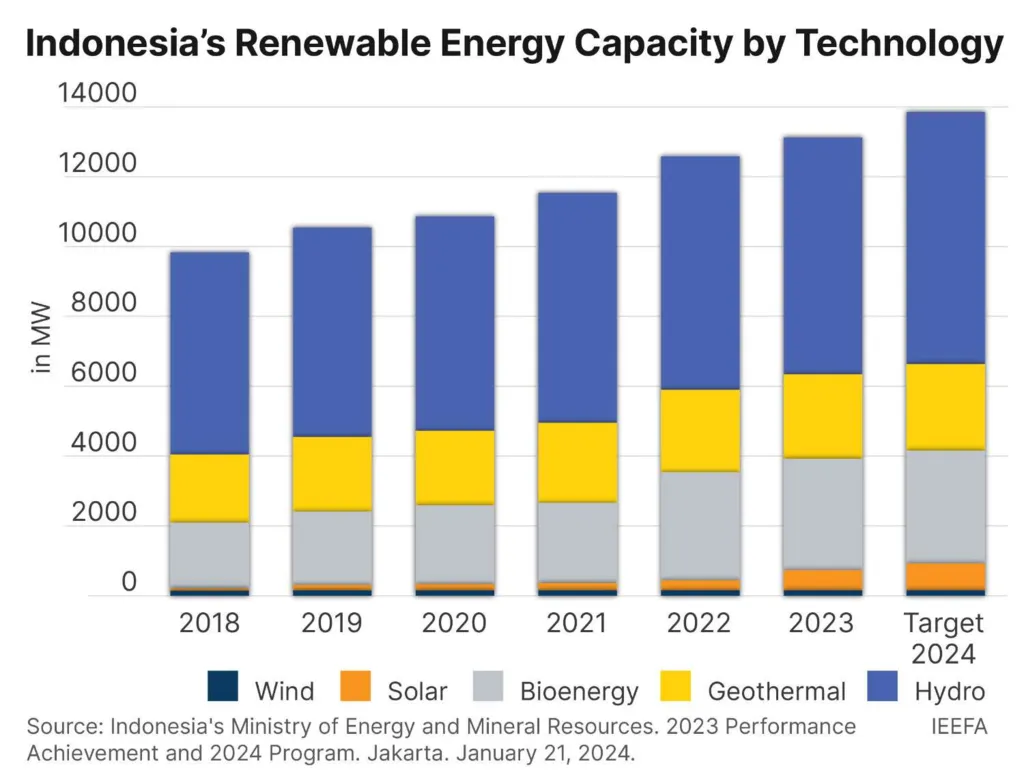

While solar dominates Indonesia’s renewable energy discourse, the country also holds 40% of the world’s geothermal reserves (estimated at 23.9GW) and 75GW of hydropower potential, offering critical baseload capacity to complement intermittent solar and wind.

Opportunities and Constraints in Indonesia Green Energy Investment

The landscape for Indonesia green energy investment is expanding. The government has opened 21 infrastructure projects to foreign investors, including two green refineries worth $860 million each. Yet, challenges remain.

Domestic solar panel production capacity is only 1,600MWp annually, far below the scale needed. Indonesia's mineral resources (like silica and critical minerals) give it a unique edge, but manufacturing must scale quickly to support the green transition.

Grid integration is another hurdle. Solar and wind require upgrades in transmission systems. Land use issues, especially outside Java, further complicate the development of large-scale projects.

Indonesia Green Energy Investment: A Call to Invest in Indonesia’s Green Future

Indonesia is positioned to be a regional leader in renewable energy, with solar PV at the core of its decarbonization strategy. The combination of vast solar potential, improving policies, and growing investor interest makes now the right time to focus on Indonesia green energy investment. To close its $146 billion funding gap, the country needs not just capital, but also innovation in grid systems, manufacturing, and financing models. For investors and climate-driven businesses, Indonesia offers both opportunity and urgency in equal measure.