Indonesia is one of the world’s fastest-growing consumer markets. With a young population and rising incomes, it’s projected to surpass $1 trillion in market value by 2024. This rapid growth is driven by strong Indonesia Consumer Market Insights—including a larger middle class, better wage growth, and more digital engagement. In 2025, real consumer spending is expected to grow by 5.2% year-on-year, hitting over IDR7,376.9 trillion at 2010 prices. Easing inflation and falling interest rates are making it easier for people to spend.

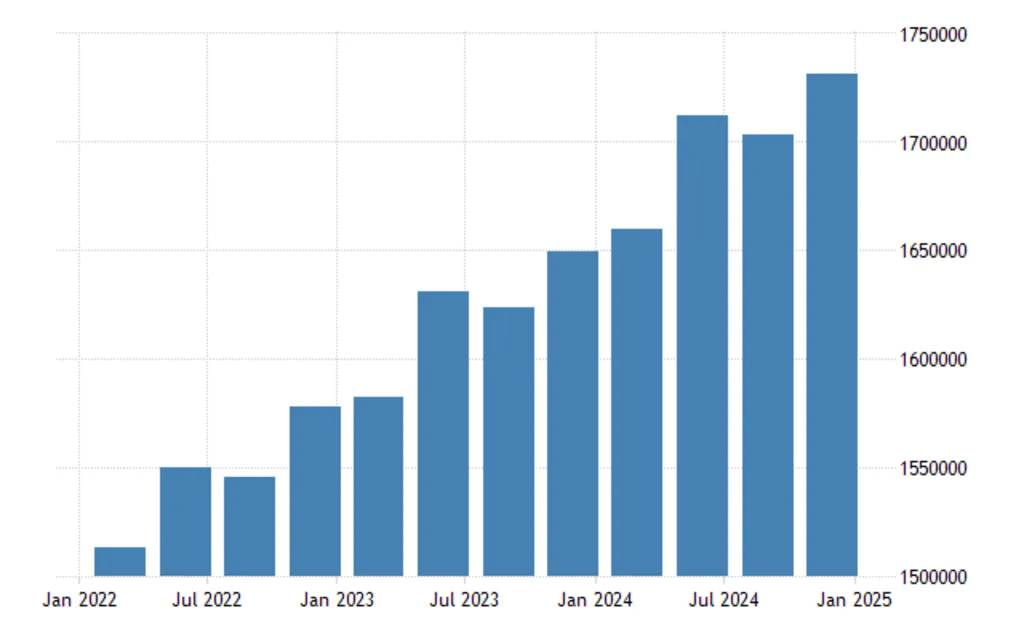

Indonesia Consumer Spending. Source: TRADING ECONOMICS

The Digital Push in Indonesia Consumer Market Insights: E-Commerce Booms

The role of online shopping continues to grow. By 2025, e-commerce sales in Indonesia are expected to hit $82 billion. This reflects a broader shift in how consumers browse, compare, and buy products—mostly through mobile phones and social media. This surge is fueled by:

- Mobile-first shopping: Over 75% of transactions happen via smartphones, with apps like Shopee, Tokopedia, and TikTok Shop leading the charge.

- Social commerce dominance: Platforms like Instagram and WhatsApp account for 30% of online purchases, as Indonesians prefer conversational buying.

- Live selling boom: Sellers on Lazada Live and TikTok LIVE see 3x higher conversion rates than traditional listings.

For brands, this means building a strong online presence is no longer optional. Digital platforms are where loyalty is built and sales are made.

Read Also: Digital Wallets & Indonesia Digital Payment Adoption Explained

The Expanding Middle Class

Indonesia’s middle class is not only growing in size, but also in spending power. By 2030, 141 million Indonesians are expected to be part of the middle class. Their annual consumption could top $2.5 trillion. This group is driving demand for quality, convenience, and trusted brands. For businesses, this opens opportunities in everything from packaged foods to personal care and household goods. A good case study example is Sosro (a local bottled tea brand) which saw 15% sales growth after launching smaller, on-the-go packs for urban commuters.

Read Also: Shifts in Indonesia Consumer Behavior Trends to KnowSpending Habits Are Evolving: Indonesia Consumer Market Insights

While consumer confidence remains high—126.4 in February 2025—people are becoming more careful with their money. Price sensitivity is rising. Shoppers are looking for promotions and discounts, but they still remain loyal to brands they trust.

A growing number of households are buying in bulk to lower costs per item. This shows how value matters more, especially in uncertain economic times. Even as retail sales stay stable—up 4.5% year-on-year in mid-2024—consumers are looking for affordable alternatives without giving up on quality.

Indonesia Consumer Market Insights: What the Trends Mean for Brands

These shifts reflect a more cautious but still confident consumer. People are spending—but they want better value. Trusted brands that can offer good prices and consistent quality will come out on top.

For businesses, understanding Indonesia Consumer Market Insights is key to long-term success. It means knowing where your customers are shopping (online), what they care about (value and trust), and how they respond to change (quickly and emotionally).

The Road Ahead

Indonesia Consumer Market Insights show that the market has enormous potential. Strong spending growth, digital habits, and a rising middle class are reshaping how people live and shop. But to succeed, companies must adapt fast—offering real value, building trust, and staying connected online. What other methods can companies try to win the customers?