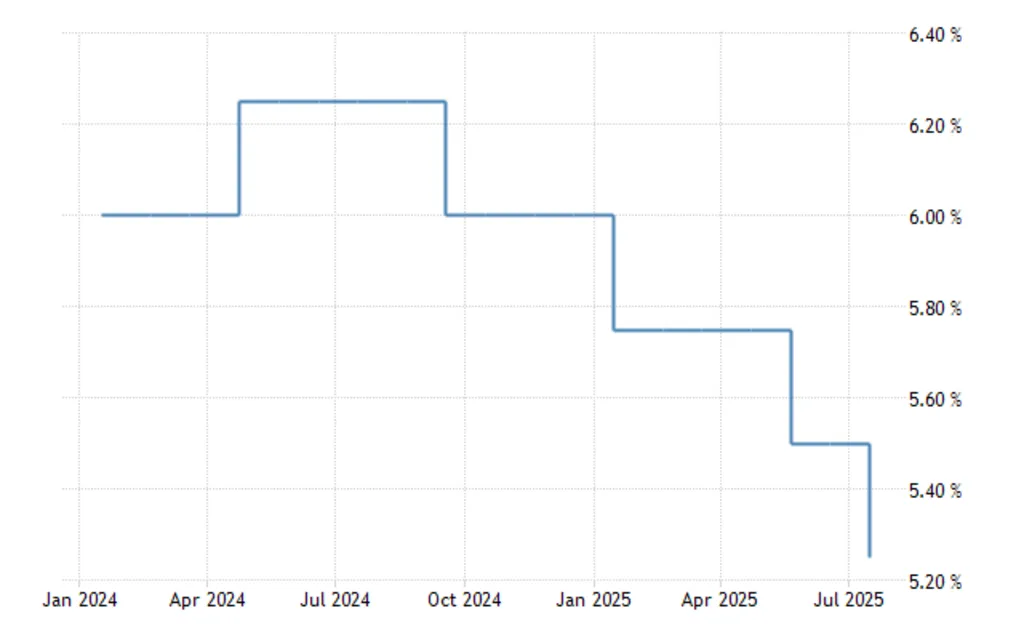

Bank Indonesia cut its benchmark interest rate by 25 basis points in July 2025, bringing it down to 5.25%. This is the third rate cut this year, following reductions in January (from 6.00% to 5.75%) and May (to 5.50%). The move was widely expected, as market analysts saw room for further easing amid slowing growth and controlled inflation.

Steady Inflation Gives Room to Loosen Policy

Inflation remains within Bank Indonesia’s comfort zone. While annual inflation edged up to 1.87% in June, it still sits well within the target range of 2.5% ±1%. In fact, despite ticking up from 1.60% in May and 1.03% in March, the central bank believes inflation will stay contained into 2026.

This predictable inflation trend has helped bolster the case for rate cuts, especially as global uncertainty continues to cloud the broader economic outlook.

Growth Slows, But Forecasts Remain Optimistic in Indonesia Interest Rate Outlook

Indonesia’s economic growth forecast for 2025 is between 4.6% and 5.4%. While the economy is still expanding, the central bank sees the need to support domestic demand and encourage lending.

Source: Trading Economics

The lower rate is intended to stimulate investment and consumer spending, particularly as global headwinds challenge export performance. So far, easing rates have aligned with a broader strategy to sustain growth without sacrificing financial stability.

Read Also: Why Indonesia Interest Rate Pause Signals Strength & Resilient

Sector-Specific Impacts of Rate Cuts

The expected 25 bp rate cut is poised to deliver targeted relief across key sectors of Indonesia’s economy. Property and construction, which contribute 10% to GDP, stand to benefit significantly as mortgage rates decline. Developers like PT PP and Summarecon have already reported a 15% increase in buyer inquiries ahead of the decision. Meanwhile, small and medium enterprises (SMEs), which account for 61% of employment, could see improved access to credit. For Bank Mandiri has signaled plans to lower SME loan rates by 30-50 bps if the central bank moves.

However, the banking sector faces margin pressures. Analysts at Maybank Indonesia estimate that a full 25 bp cut could reduce net interest margins by 5-8 basis points for major lenders like BCA and BRI, though increased loan volume may offset this. These dynamics highlight how Bank Indonesia’s decision balances growth stimulation with financial system resilience.

Rupiah Holds Firm, Adding Policy Flexibility

One important factor behind the recent rate decision is the relative stability of the Rupiah. In June, the currency appreciated 0.34% against the US dollar, signaling investor confidence and effective central bank interventions.

Currency stability has given policymakers the flexibility to ease rates without worrying about triggering capital flight or FX volatility.

Indonesia Interest Rate Outlook: Wider Monetary Tools Also Adjusted

Along with the benchmark rate cut, Bank Indonesia also adjusted its corridor rates: the Deposit Facility was lowered to 4.50%, and the Lending Facility to 6.00%. This reflects a coordinated easing approach, designed to keep financial conditions accommodative across the board.

Read Also: Indonesia Central Bank Liquidity: A Strong, New Era Unfolds

A Clear Signal in an Uncertain World

This latest move strengthens the current Indonesia interest rate outlook, reflecting a clear policy direction: support growth, manage inflation, and maintain stability. With inflation under control, a steady currency, and a need to boost economic activity, Bank Indonesia acted as expected, and decisively. Whether additional rate cuts are in store will depend on global conditions and domestic indicators in the second half of the year. For now, the message is clear: monetary policy is on Indonesia’s side.