The Indonesia retail market is undergoing major change. With a projected expansion of USD 49.9 billion from 2025 to 2029 and a CAGR of 4.7%, the sector is not just growing but transforming. These figures reflect a resilient economy and a shifting consumer mindset that favors convenience, digital access, and local relevance. Let's break Indonesia Retail Market Insights down!

E-Commerce Doubles Its Share

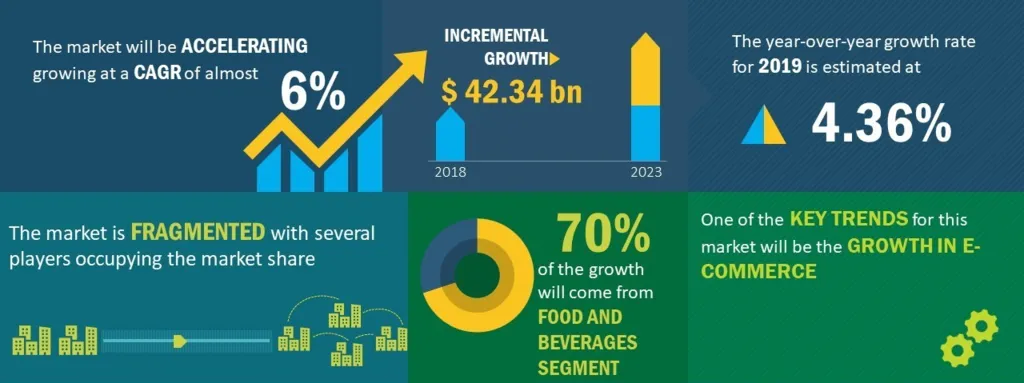

One of the biggest changes in recent years has been the rise of e-commerce. In 2024, online retail accounts for 22% of the total market, nearly double from 11.5% in 2022. This dramatic growth shows how digital platforms are becoming the default shopping option for many Indonesians.

By 2027, e-commerce is expected to hold 21.8% market share, maintaining its strong influence even as traditional retail continues to evolve. This highlights the role of digital transformation in shaping future retail strategies.

Digital Youth Are Leading the Shift in Indonesia Retail Market Insights

Younger consumers are driving this change. People in their 20s and 30s now make up 88% of Indonesia’s online retail user base. They’re mobile-first, tech-savvy, and quick to adopt new trends. Digital wallets now facilitate 40% of online payments, showing just how embedded technology has become in daily life.

Read Also: Digital Wallets & Indonesia Digital Payment Adoption Explained

Retailers are responding with omnichannel strategies—blending online, offline, and mobile shopping to offer a smoother, more personal experience. Social commerce, where products are bought directly through platforms like Instagram or TikTok, is also gaining ground thanks to high social media use.

Read Also: What Drives Indonesia Consumer Market Insights? Trends to Know!

Category Highlights: Food, Electronics, and Local Brands

Food and beverage remain essential in Indonesia's retail mix. In 2022, the sector grew 4.9%, reaching IDR 813.062 billion. Supermarkets and hypermarkets are now leaning into premium and imported items as consumer expectations rise.

Electronics are also booming. In Q3 2023, the category grew by 13.68%, now contributing 8.3% to the manufacturing sector. This signals strong consumer demand for tech products, especially as digital lifestyles become the norm.

Local brands are thriving too. Many Indonesian shoppers now prefer homegrown labels, attracted by cultural familiarity, value, and faster delivery. This growing preference adds a new dimension to Indonesia Retail Market Insights, as domestic players rise alongside global brands.

Retail Resilience Despite Headwinds

Despite some economic pressures, the market continues to grow. Retail sales rose 2.7% year-on-year in June 2024, following a 2.1% increase in May. Though growth is slower than expected, it still points to strong consumer resilience.

These gains come even as inflation and global uncertainty affect purchasing power. Consumers are shopping smarter, using digital tools to compare prices, find discounts, and choose brands that offer both quality and affordability.

Read Also: What's Driving Southeast Asia Consumer Behavior Trends?

The Role of Technology and Innovation in Indonesia Retail Market Insights

Technology is now essential for retail success. Retailers are adopting tools like data analytics, AI-powered chatbots, and automated inventory systems to serve customers better and stay ahead of trends. What works today is speed, personalization, and reliability. That’s why so many retailers are investing in last-mile delivery, customer loyalty programs, and seamless app experiences.

Final Outlook of Indonesia Retail Market Insights

The Indonesia Retail Market Insights point to a sector that is not just growing, but evolving fast. With digital innovation, youthful consumers, and a strong local brand presence, the future of retail in Indonesia is bright—and dynamic. Retailers who act now—investing in tech, local relevance, and omnichannel strategies—will be best positioned to thrive in this rapidly changing landscape.