Indonesia’s economy has shown impressive resilience in 2025, with Bank Indonesia holding its key interest rate steady at 5.5% to balance inflation control and growth. Export values rose by 6.65% between January and April 2025, indicating strong external trade activity despite global uncertainty. Yet behind these promising numbers, a new concern is emerging: the Indonesia Trade Diversion Effects caused by Chinese exports rerouted through the country. Let's take a closer look!

Indonesia Trade Diversion Effects: Sharp Rise in Chinese Imports

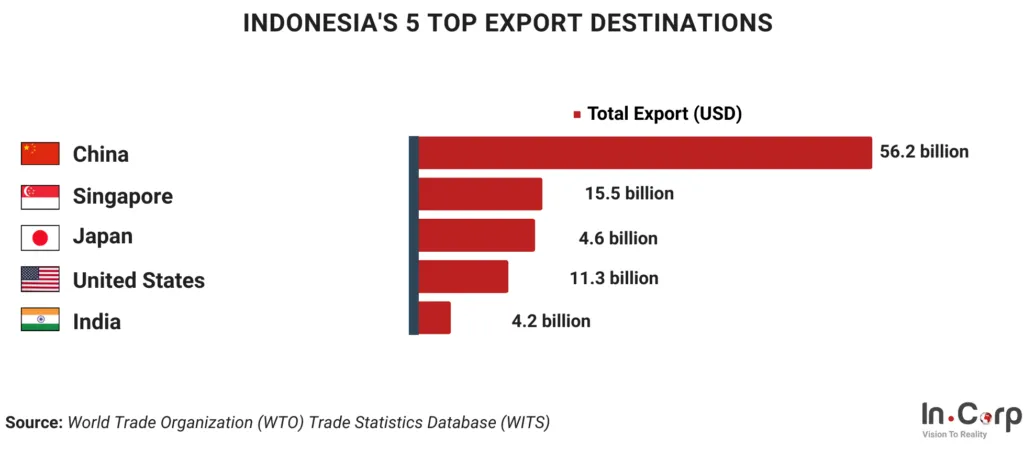

In the first four months of 2025, imports from China to Indonesia jumped 22.4% year-on-year, reaching $25.8 billion. Meanwhile, Indonesia’s exports to China only grew by 7%, leading to a trade deficit with China of $6.3 billion, or double compared to the same period last year.

A large share of these imports includes electrical machinery, mechanical equipment, steel, and automotive parts. These sectors are central to recent trade diversion trends, where Chinese goods are believed to be re-routed through Indonesia to bypass US and EU tariffs. This pattern underlines the growing trade diversion effects, which pose challenges for domestic industries and trade balance.

A 25% Surge in Rerouted Goods

Research shows a 25% increase in Chinese goods being routed through Indonesia, especially in high-value industrial sectors. The main driver behind this surge is the ongoing trade tensions between China and major economies like the US and EU. Facing steep tariffs abroad, Chinese exporters are increasingly using Southeast Asian countries as alternative transit hubs.

Indonesia, with its strategic location and strong manufacturing base, has become an attractive point of entry for these goods. While this supports short-term trade figures, it raises concerns about long-term economic implications and the authenticity of export growth numbers.

Implications for Indonesia’s Economy

The Indonesia Trade Diversion Effects go beyond simple trade statistics. Economist Syafruddin Karimi warns that any normalization of US-China trade relations could quickly reverse these gains. Indonesia could see reduced export opportunities and increased vulnerability if foreign demand shifts away or if global trade tensions ease.

Moreover, the flood of rerouted Chinese goods can pressure local manufacturers, who may struggle to compete against cheaper imports. This situation risks undermining Indonesia’s efforts to strengthen its domestic industry and reduce reliance on imports.

Read Also: Game-Changing Indonesia QRIS Cross-Border Payments To Know

Balancing Benefits and Risks of Indonesia Trade Diversion Effects

Despite official statements denying trade diversion issues, data trends tell a different story. The sudden surge in imports and the widening trade deficit with China highlight the urgent need for policy adjustments. Strengthening import monitoring, tightening transshipment regulations, and supporting local manufacturers are critical steps to mitigate the Indonesia Trade Diversion Effects.

At the same time, Indonesia must continue to build economic resilience through export diversification and improved trade agreements, ensuring that its growth is not overly dependent on redirected flows from global disputes.

Looking Ahead: Indonesia Trade Diversion Effects

Indonesia’s strong export growth and stable interest rate policy suggest a robust economic foundation. However, the increasing reliance on rerouted Chinese goods could pose significant challenges if not addressed proactively. By understanding and managing the Indonesia Trade Diversion Effects, policymakers can better protect local industries, safeguard economic stability, and strengthen Indonesia’s long-term position in global trade.

Read Also: Strengthening Exports with Indonesia Blockchain Traceability