Indonesia’s digital payment system, QRIS (Quick Response Code Indonesian Standard), is rapidly transforming how money moves. And this is not just at home but across Southeast Asia. With 2.6 billion transactions in Q1 2025 worth approximately $15.5 billion, QRIS has become a core engine in Indonesia’s push toward a cashless, connected economy. At the heart of this growth is the rise of Indonesia QRIS cross-border payments. From coffee shops in Jakarta to shopping malls in Bangkok or Kuala Lumpur, QRIS now powers seamless payments across borders—fueling trade, tourism, and financial inclusion.

Domestic Foundation: 56 Million Users and Counting

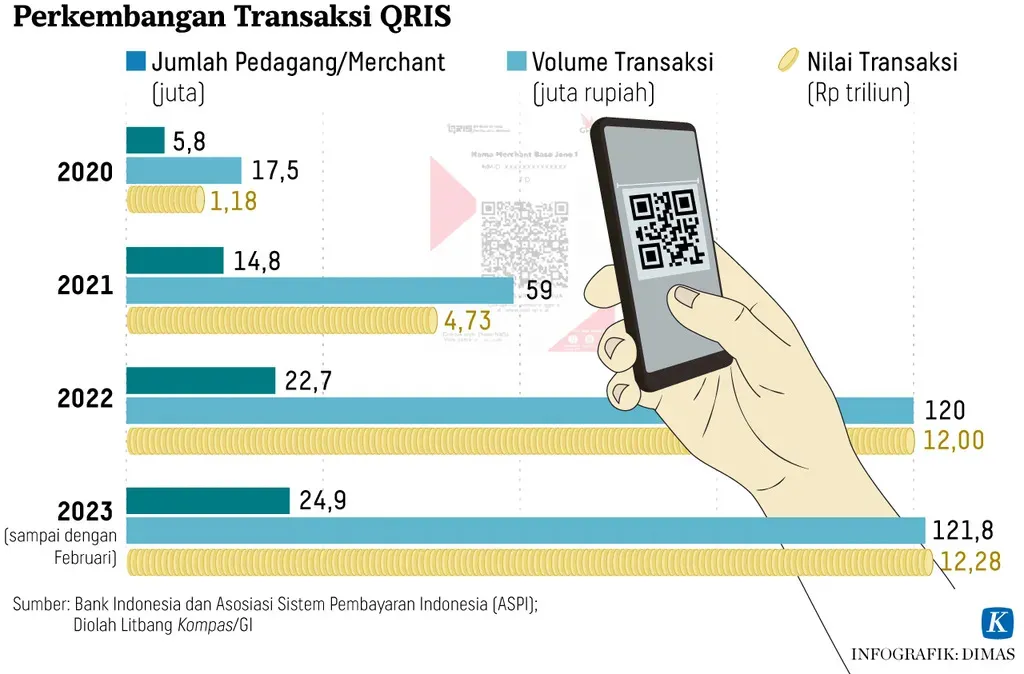

QRIS adoption at home has exploded. Between Q1 2024 and Q1 2025, users grew from 48 million to 56.3 million, while merchants jumped from 32 million to 38.1 million. Impressively, 92.5% of merchants are MSMEs, showing QRIS’s strong impact on small business empowerment and financial access.

Since its launch, Indonesians have conducted 3.7 billion QRIS transactions. This isn't just about convenience—it’s about modernizing a large, diverse economy and bringing millions into the digital financial system.

Indonesia QRIS Cross-Border Payments Growth: From ASEAN to Asia-Pacific

QRIS is no longer just a national tool—it’s going global. Between January and April 2025, Bank Indonesia recorded 24,121 inbound QRIS payments totaling IDR 7.1 billion, with tourists from Malaysia, Singapore, and Thailand leading adoption.

Year-on-year, cross-border QRIS transactions surged 225.54%, with Malaysia showing a 238% increase. Month-on-month growth among Indonesian users in Malaysia and Thailand ranges from 4% to 9%, showing strong outbound usage as well. These numbers underscore how QRIS is becoming the preferred method for frictionless regional payments.

Beyond ASEAN, QRIS has signed deals with South Korea and the UAE, with plans to launch in Japan and India soon. This positions Indonesia as a regional pioneer in cross-border QR technology—linking local currency transactions with global convenience.

Read Also: Massive Momentum in Indonesia Digital Economy Growth

Economic Impact: A Rising Share of GDP

QRIS is now processing transactions equal to nearly 5% of Indonesia’s GDP, a stunning indicator of its influence on the real economy. It’s not just a payment method—it’s an infrastructure layer that supports tourism, retail, services, and remittances.

During the first quarter of 2025 alone, QRIS facilitated 2.6 billion transactions, a nearly 600% increase from the same period in 2024. That’s not evolution—it’s transformation.

What Makes Indonesia QRIS Cross‑Border Payments Work?

Key to QRIS’s success is its simplicity and integration. It supports local currency transactions (LCT), minimizing conversion costs and making it ideal for travelers and micro-merchants alike.

Moreover, Bank Indonesia’s partnerships with regional counterparts are not just technical—they’re policy-driven, fostering cooperation in payments, regulation, and digital finance strategy. This makes QRIS scalable, sustainable, and exportable.

Read Also: Exploring Newest Indonesia Fintech Ecosystem Expansion Trends

Indonesia QRIS Cross‑Border Payments: Leading the Regional Cashless Future

The numbers tell a clear story. QRIS is not just a success within Indonesia—it’s becoming a model for regional payment innovation. With over 56 million users, 38 million merchants, and soaring cross-border volume, Indonesia QRIS cross-border payments are enabling a truly inclusive, regional cashless economy.

From the streets of Jakarta to the shops of Kuala Lumpur and the cafes of Bangkok, QRIS is fast becoming the go-to solution for seamless, borderless payments in Asia. And with its global ambitions now taking shape, its impact is just getting started.