The Indonesia FMCG Market Evolution is shaping the way brands operate, innovate, and connect with consumers. Valued at over USD 100 billion, Indonesia’s fast-moving consumer goods (FMCG) market is one of the largest and fastest-growing in Southeast Asia. It’s projected to grow at a 7.6% compound annual growth rate (CAGR) from 2021 to 2025. This isn’t just big—it’s deeply rooted. Since 2018, households in Indonesia have spent nearly 20% of their total expenses on FMCG products. That shows just how essential these goods are to everyday life.

Indonesia FMCG Market Evolution is Growing Despite Headwinds

Even in tough economic conditions, FMCG spending is rising. In Q3 2024, Indonesian consumers spent IDR 208 trillion on FMCG goods—a 1.1% increase from the previous year. Inflation hasn’t stopped people from shopping, but it has shifted how they shop.

In 2022, the FMCG market saw value growth of 9%, up from 5% the year before. However, unit sales only grew 2%. This suggests consumers are buying fewer items but spending more per item. People are choosing smaller packs, switching brands, or going for products with more value.

Traditional Channels Dominate—For Now

Even with all this change, traditional trade channels—like small shops and warungs—still lead, with a 69% market share in Q2 2024. These outlets remain central to daily life, especially in rural areas.

But change is on the way. Online sales are growing fast. The online grocery market alone is expected to reach USD 27 billion by 2028. More Indonesians are choosing to shop from their phones, favoring convenience, speed, and home delivery.

Indonesia FMCG Market Evolution: E-Commerce, Digital Delivery, and New Habits

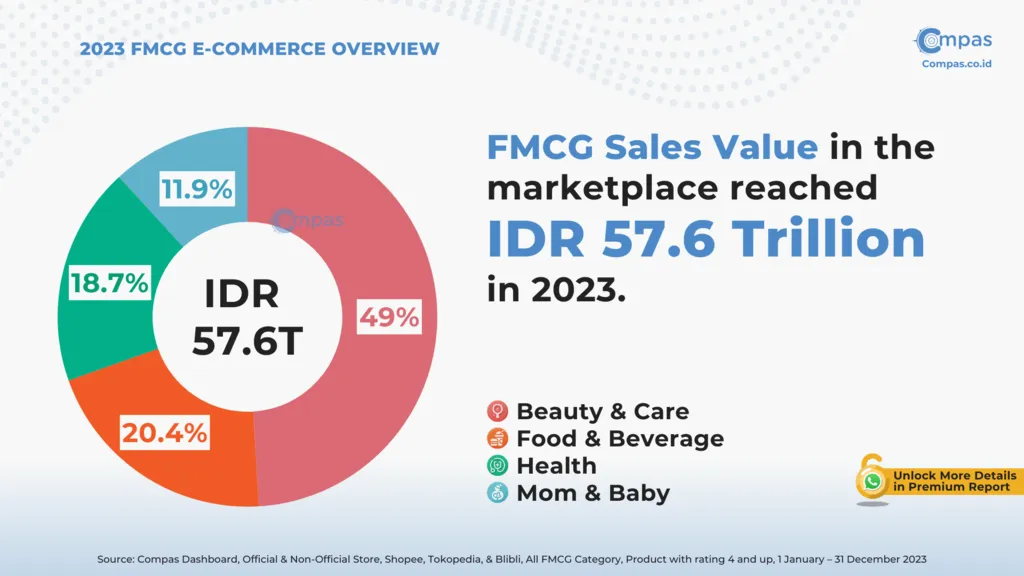

E-commerce isn’t just for gadgets and clothes anymore. FMCG brands are now investing heavily in digital platforms and last-mile delivery. Shoppers want quick, easy access to their favorite products—without stepping outside. This shift is being driven by younger consumers, urban dwellers, and busy families. They value convenience, digital payment options, and the ability to compare prices or find deals online.

Read Also: What Drives Indonesia Consumer Market Insights? Trends to Know!

Read Also: Digital Wallets & Indonesia Digital Payment Adoption Explained

Innovation for the Modern Shopper

To keep up with these trends, companies are rethinking their products. There’s rising demand for:

- Healthier options

- Smaller pack sizes

- Unique flavors

- Functional products (like drinks with added vitamins)

This reflects a broader move toward wellness, personalization, and convenience.

Sustainability is also gaining ground. More Indonesian consumers are seeking eco-friendly packaging and ethically sourced ingredients. FMCG companies are responding with green initiatives and supply chain improvements to meet these new expectations.

The Power of Local Brands

While global brands compete for shelf space, local brands are thriving. One standout example is Indomie, which achieved an impressive 97% household penetration in 2023. This shows the strength of homegrown labels that understand local tastes and needs.

Domestic brands are often quicker to adapt, more price-sensitive, and deeply trusted by consumers. Their success is a reminder that understanding local preferences is key in a fast-changing market.

Indonesia FMCG Market Evolution: What’s Next?

The Indonesia FMCG Market Evolution is far from over. With rising incomes, a young population, and a growing middle class, the market still holds massive potential. But winning in this space will require more than just great products. Companies must focus on digital transformation, consumer insight, and sustainable innovation. Those that adapt quickly to evolving habits—both online and offline—will lead the next wave of growth in Indonesia’s dynamic consumer economy.