After nearly 10 years of negotiations, the Indonesia-EU Trade Deal has been finalized, marking a major breakthrough in global trade diplomacy. The Comprehensive Economic Partnership Agreement (CEPA), signed in July 2025, is expected to reshape Indonesia’s export landscape and strengthen its role in the global economy.

Indonesia-EU Trade Deal Finalized: Zero Tariffs and Wider Market Access

One of the biggest highlights of the Indonesia-EU Trade Deal finalized is the elimination of tariffs on about 80% of Indonesian exports to the EU within the next one to two years. This move opens new doors for key sectors such as textiles, electronics, and minerals, allowing them to expand their footprint in the European market without cost barriers.

For small and medium-sized businesses (SMEs), this is a golden opportunity to access premium markets and scale up production. The zero-tariff clause significantly boosts Indonesia’s export competitiveness, helping local industries grow beyond regional limits.

US$60 Billion Trade Ambition

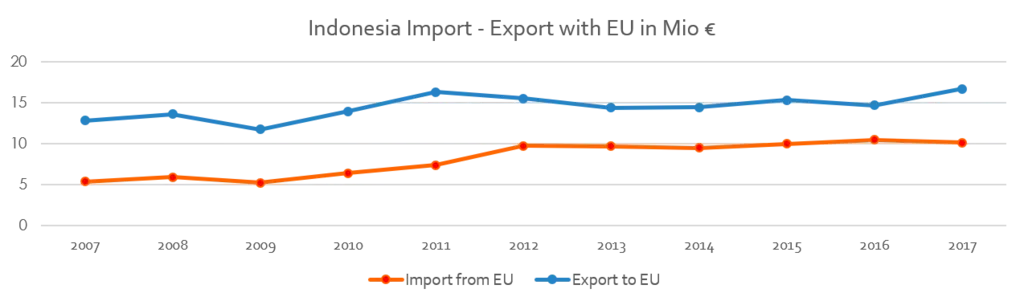

The numbers speak for themselves. Indonesia’s exports to the EU reached US$17.5 billion in 2024, making the EU its fifth-largest trading partner. With CEPA now in place, bilateral trade is expected to double to US$60 billion in the coming years.

This surge will not only benefit exporters but also help balance trade flows. Indonesia’s trade surplus with the EU grew from US$2.5 billion in 2023 to US$4.5 billion in 2024, and the new agreement is expected to accelerate this trend.

Read Also: Strengthening Exports with Indonesia Blockchain Traceability

Palm Oil, EVs, and Textiles

This bilateral trade brings particularly transformative benefits for strategic industries. Palm oil, long subject to EU sustainability scrutiny, will now gain tariff-free access for certified sustainable producers, potentially boosting exports by $1.2 billion annually. Meanwhile, electric vehicle (EV) components, which are a priority under Indonesia’s downstreaming policy, will see tariffs on lithium battery exports drop from 5% to 0%. As a result, this will accelerate the country’s push into green manufacturing.

Textile and footwear exporters, who previously faced EU tariffs of 6-12%, stand to gain $800 million in annual savings. Major players like PT Sri Rejeki Isman are already expanding production lines to meet anticipated demand. The deal also includes mutual recognition of 21 Indonesian Geographical Indications (GIs), protecting premium products like Java coffee and Bali cashews in the EU market.

Economic Boost: A New Growth Engine

A report from CSIS estimates that the CEPA could increase Indonesian exports to the EU by 57.76% and EU exports to Indonesia by 76.17% once the agreement is fully implemented. This boost in trade will directly benefit the economy. Experts predict that Indonesia’s GDP could grow by an additional 0.19 percentage points, a meaningful gain in a country growing at around 4.87% in early 2025.

Read Also: Indonesia GSP Supported Projects Shape The Nation's Export Future

Indonesia-EU Trade Deal Finalized: More Than Trade

Beyond tariffs, the Indonesia–EU Trade Deal finalized includes visa facilitation for business professionals. This means fewer travel restrictions, faster processing, and easier movement for investors and business operators. The deal also encourages greater foreign investment and collaboration, especially in high-value industries.

This new mobility is essential to support the physical and operational expansion of Indonesian businesses in Europe, paving the way for joint ventures, technology transfer, and skilled labor exchanges.

Indonesia-EU Trade Deal Finalized: A Historic Deal with Long-Term Gains

The Indonesia-EU Trade Deal finalized marks a historic shift in Indonesia’s global economic engagement. By removing trade barriers and promoting investment-friendly policies, CEPA sets the stage for sustainable growth and deeper global integration. With strong policy support and clear economic benefits, this deal is a launchpad for a new era of trade, innovation, and prosperity for Indonesia.

Read Also: Chinese Reroutes & Indonesia Trade Diversion Effects