Indonesia’s manufacturing sector is on the rise, powered by deepening global partnerships, strategic export programs, and steady investment growth. In 2023, the country’s manufacturing exports hit $186.98 billion, accounting for more than 72% of total exports. The sector also recorded an output of $255.96 billion, reflecting its role as the backbone of Indonesia’s economy. At the center of this momentum are the Indonesia GSP supported projects, which are quietly reshaping the country’s integration into global value chains. Let's take a closer look!

Indonesia GSP Supported Projects: Exports and Economic Reach

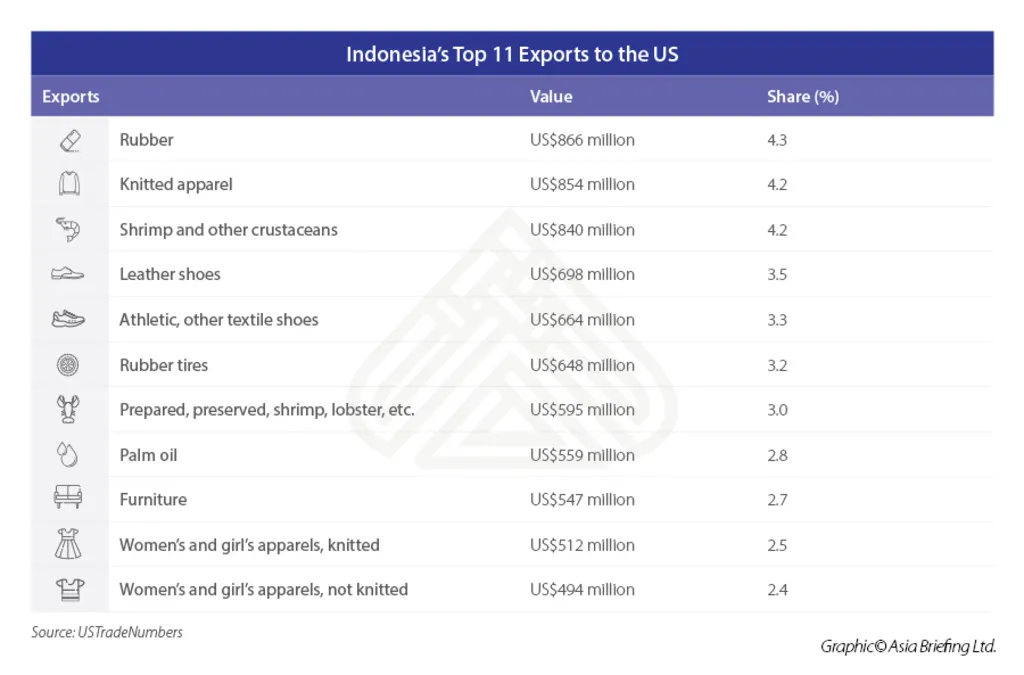

The United States Generalized System of Preferences (GSP) has helped Indonesian businesses access the U.S. market with reduced tariffs on over 3,500 products. By 2018, these exports totaled $2.1 billion annually, and in 2019, GSP-eligible shipments climbed to $1.6 billion from January to August—up from $1.2 billion during the same period the year before.

These benefits go beyond trade numbers. Since inception, Indonesia’s Small Grants Programme (SGP) has backed 644 projects, mobilizing $13.5 million in grants and attracting $17.98 million in co-financing. These initiatives have supported biodiversity, climate adaptation, and land management—while also linking local communities to export markets.

Job Creation and Regional Competitiveness

Indonesia’s manufacturing sector employs over 19 million workers, with labor productivity reaching $14/hour, outpacing Vietnam’s $10/hour. While rivals like Vietnam and Malaysia have gained traction under the China+1 strategy, Indonesia is closing the gap by focusing on value-added production and policy incentives for global investors.

Read Also: The Impact of Indonesia Urbanization Trends on Society

From 2016 to 2023, SGP-backed efforts impacted 67 communities, strengthened 1,284 civil society organizations, and helped conserve over 360,000 hectares of land. This proves that sustainability and competitiveness can go hand in hand.

Read Also: Upskilling Indonesia’s Construction Workforce with Training

Export Diversification and Value Chain Integration

Indonesia’s trade is deeply embedded in regional supply networks. As of 2015, nearly 70% of its trade involved intermediate goods, with 65% of domestic value-added exports remaining within East and Southeast Asia.

Looking ahead, Indonesia is pushing hard for export diversification. The country is moving beyond commodities like minerals and chemicals by investing in downstream manufacturing and industrial zones such as Batam, which are tailored to meet global sourcing demands.

The results are clear: Indonesia’s value-added exports have grown over 300% since 1995, especially in manufacturing (41%) and mining (33%). These gains highlight the country’s steady march up the value chain.

Challenges and the Road Ahead: Indonesia GSP Supported Projects

Despite these advances, regulatory complexity, infrastructure constraints, and global competition remain hurdles. Vietnam and Malaysia have so far been more agile in attracting firms relocating from China. To stay competitive, Indonesia must double down on reforms, incentives, and digital infrastructure to reduce barriers to entry.

Still, with growing FDI in resource-based industries, strategic use of GSP advantages, and continued SGP-backed development, the foundation is strong.

Read Also: Indonesia Infrastructure Development Plans: Current and Future Outlook

Indonesia GSP Supported Projects: Strategic Shifts, Tangible Gains

Indonesia GSP supported projects are more than development programs—they are tools for long-term economic transformation. Coupled with global supply partnerships and a growing manufacturing base, Indonesia is carving out a resilient, export-ready future. The path to full integration into global value chains is still evolving, but the nation is clearly on the move.