Indonesia enters 2025 with steady confidence. The government targets 5.2% growth, and major global institutions like the IMF and World Bank share a similar view at 5.1%-5.2%. Even with global pressure, the direction of Indonesia Economic Outlook 2025 shows stability and discipline.

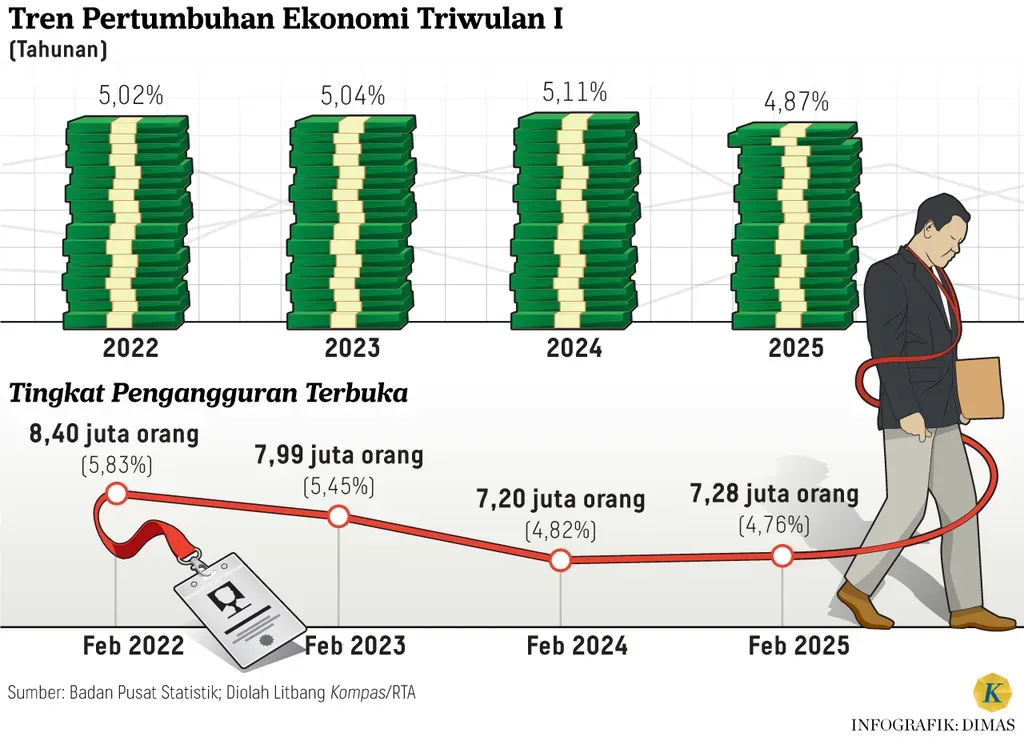

In Q1 2025, the economy expanded by 4.9%. This growth came during a period marked by global trade tensions and falling commodity prices. Yet Indonesia pushed forward, supported by low inflation and strong fiscal rules. These policies protected investment, kept markets steady, and built trust among businesses after the election period.

Strong Indicators Set the Tone for Indonesia Economic Outlook 2025

The OECD projects Indonesia’s real GDP growth to reach 4.7% in 2025. It expects easing financial conditions that will boost private consumption and investment. This matters because household spending remains a major driver of Indonesia’s economy. A stable monetary environment means people and businesses feel safe to spend, invest, and plan.

All forecasts show one message: Indonesia’s economy is expanding at a healthy, consistent pace. This positions the country well as it continues its long-term path toward the “Golden Vision.”

Read Also: Indonesia Fintech Policy Trends & the Future of Payments

Downstreaming Becomes the Centerpiece of Growth

"Hilirisasi," or downstreaming, has become the government's main economic focus. It aims to move Indonesia away from raw mineral exports and into high-value processing industries at home. The strategy in this Indonesia Economic Outlook 2025 is starting to show clear results.

In Q3 2025, the contribution of downstream investment jumped by 5 percentage points, reaching around 30% of total investment. This shift proves that policies designed to push industrial development are working.

The government also approved a major downstreaming plan worth $40 billion in 2025. The plan focuses on energy and mining, with 21 flagship projects that support domestic production and reduce reliance on foreign imports. These projects are expected to anchor long-term value creation, especially in metals, batteries, and processing industries.

Broad Sectoral Gains Add Momentum

Downstreaming is not only about minerals. Sectors like palm oil, timber, and rubber are also gaining from added-value processing. Their contributions amount to trillions of rupiahs, strengthening the economy while building global competitiveness.

These downstream industries create jobs, increase exports, and develop local supply chains. They also help Indonesia avoid the volatility of global commodity markets by moving away from raw material dependence.

Post-Election Stability Supports Economic Confidence

Indonesia’s post-election environment has remained stable. Strong macroeconomic policies helped maintain economic confidence. Low inflation, fiscal discipline, and continuous investment support allowed the country to navigate global uncertainty without losing momentum.

Read Also: Indonesia Cross-border Fintech Expansion Is Driving ASEAN Change

The outlook for 2025-2027 shows average annual growth of around 4.8%. This growth is backed by downstreaming and ongoing structural reforms. These reforms aim to raise productivity, attract more investment, and create a stronger, more resilient economy.

Indonesia Economic Outlook 2025: The Path Toward the Golden Vision

Indonesia’s progress in 2025 reflects the mix of discipline and ambition needed to reach its long-term national goals. Downstreaming has shown real impact through rising investment, expanding industries, and stronger economic stability.

The Indonesia Economic Outlook 2025 highlights how strategic planning can strengthen a nation even during turbulent times. As Indonesia continues advancing toward its “Golden Vision,” businesses and investors will seek expert guidance to navigate new opportunities. To explore how Market Research Indonesia can support this journey with global insights and advisory services, reach out to their team for more information.