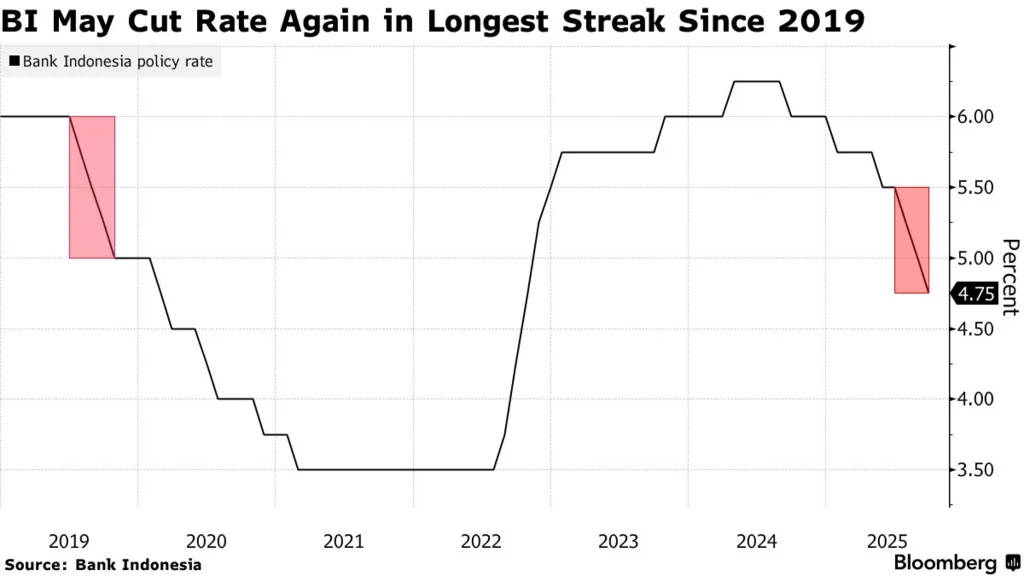

The Indonesia Rate Cut Pause Impact is now coming into focus after Bank Indonesia (BI) surprised markets by holding its key interest rate steady at 5.50% on June 18, 2025. The decision comes amid clear signs that the country’s credit growth has slowed below target, raising questions about whether tighter financial conditions are beginning to bite into economic momentum.

A Strategic Pause to Protect Stability

The Indonesia Rate Cut Pause Impact is being felt across markets. BI’s decision was guided by a need to maintain currency stability in a time of rising global uncertainty and the lingering effects of U.S. tariff policies. By holding rates, the central bank aims to shield the rupiah from volatile capital flows that could worsen inflation or erode investor confidence.

At the same time, BI emphasized its flexibility. The central bank signaled it might resume rate cuts later in the year if the currency strengthens and external pressures ease. This cautious tone reflects the bank’s balancing act between stimulating growth and protecting financial stability.

Read Also: Indonesia’s Digital Banking Revenue Forecast to Hit USD 8.6B by 2029

Indonesia Rate Cut Pause Impact: Credit Growth Slows Below Expectations

The most pressing concern lies in credit activity. As of June 2025, total bank credit reached Rp8,060 trillion (US$494 billion), marking only a 7.77% year-on-year increase—a clear slowdown from 8.43% in May. This shortfall shows that even though liquidity remains available, businesses and consumers are borrowing less.

Such weak lending momentum has broader implications. Sluggish credit growth is often an early signal of softening demand, reduced business expansion, and lower household spending. BI’s restrictive stance—while justified for currency defense—has inevitably tightened financial conditions, leading to slower money circulation in the real economy.

Growth Remains Uneven Across Sectors

The broader economy continues to expand but with uneven strength. Indonesia’s Q2 2025 GDP rose 5.12% year-on-year, its fastest pace in two years. Yet this headline number hides disparities. Much of the growth came from frontloaded exports as firms rushed shipments ahead of new tariff rules. Meanwhile, domestic investment has been sluggish, and manufacturing momentum is faltering.

The Manufacturing PMI slipped into contraction territory in July 2025, pointing to reduced factory output and weaker orders. These signals suggest that BI’s rate stance, while defending the rupiah, may be restricting sectoral recovery and slowing employment growth.

Inflation Near the Top of Target Range

BI’s policymakers face another challenge: inflation. Consumer prices climbed to 2.37% in July from 1.87% in June, a one-year high but still within the 2–4% target range. This increase gives BI limited space to ease policy further without risking overheating.

With inflation near the upper end of its range and lending slowing, BI is in a tough spot. A premature rate cut could weaken the rupiah or fuel imported inflation, while maintaining high rates could further strain credit and consumption.

Forecasts Highlight a Narrow Path Forward: Indonesia Rate Cut Pause Impact

BI expects GDP growth in 2025 to fall between 4.6% and 5.4%, a range that underscores both optimism and caution. Policymakers recognize that household spending and investment must remain key drivers of growth as exports face headwinds from tariffs and slower global trade.

Yet, the credit slowdown shows that tight policy is already squeezing liquidity. “Credit growth slowed to just 7.77% year-on-year in June 2025, showing tangible evidence of the drag high interest rates can exert on economic expansion,” one policy summary noted. Unless BI finds a window to ease rates, growth could slip to the lower end of its forecast.

Read Also: Indonesia Cross-border Fintech Expansion Is Driving ASEAN Change

The Indonesia Rate Cut Pause Impact Outlook

The Indonesia Rate Cut Pause Impact is a reminder of how delicate monetary policy can be in uncertain times. BI must walk a fine line by supporting growth without inviting currency risk. For investors and businesses, to understand how such macroeconomic shifts could affect your sector or investment plans, consider exploring Market Research Indonesia’s advisory services. As a global consulting firm, Market Research Indonesia helps businesses interpret policy changes and craft resilient growth strategies in emerging markets like Indonesia.