Indonesia’s fintech industry is no longer just a domestic story. Over the past decade, it has become one of the region’s strongest digital finance engines. From only 51 firms in 2011, the number of fintech companies in Indonesia soared to 334 by 2022. This explosive rise has set the stage for something bigger. We are witnessing a powerful Indonesia Cross-border Fintech Expansion across ASEAN.

In 2024, fintech made up 32% of Indonesia’s total equity funding. That shows strong investor confidence in the sector’s innovation and potential. With US$141 million raised across 23 deals that year, much of that capital is fueling regional growth. Indonesian startups aren’t just scaling at home. They’re crossing borders to compete and collaborate across Southeast Asia.

Integrating ASEAN Payments in Indonesia Cross-border Fintech Expansion

A key driver of this expansion is interoperability. Indonesia’s e-wallets are now increasingly connected to ASEAN’s regional payment systems. That means users can make seamless transactions across countries like Singapore, Malaysia, and Thailand. It’s a big step toward regional financial integration, reducing barriers that once made cross-border payments slow and costly.

This integration allows millions of users and businesses to operate more efficiently, whether paying for goods, services, or subscriptions. It also strengthens ASEAN’s goal of a unified digital economy. Indonesia’s leadership in this area shows how local innovation can evolve into regional infrastructure.

Read Also: Indonesia’s Fintech Revolution Goes Regional: Expanding Across ASEAN Borders

Indonesia Cross-border Fintech Expansion: Fintech Export and Regional Growth

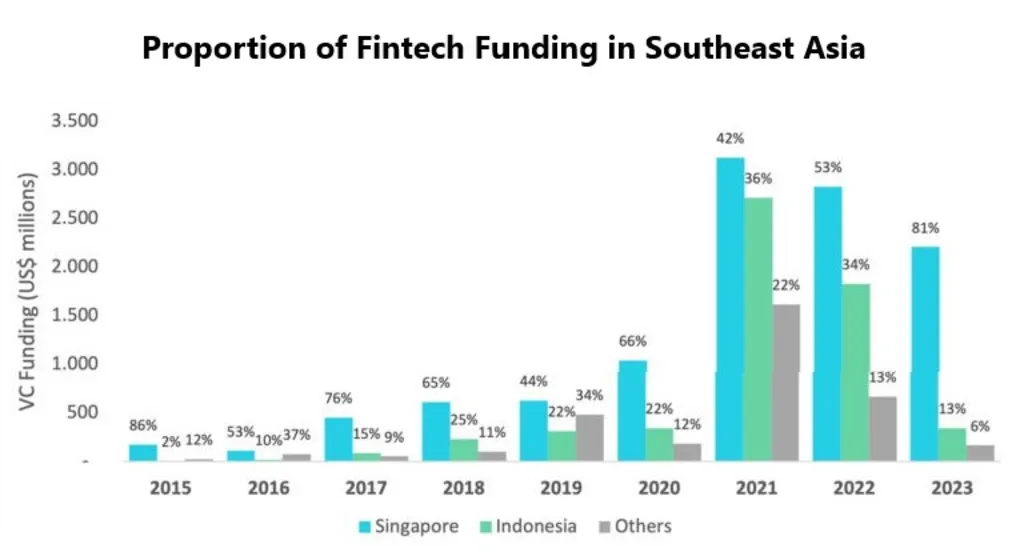

The region’s fintech funding has grown more than tenfold since 2015. This surge supports startups like Indonesia’s Qoala, which raised an impressive US$8.2 billion to expand its micro-insurance services across Southeast Asia. That single move shows how Indonesian fintech is now exporting technology, products, and expertise to other ASEAN markets.

These developments highlight a shift from domestic focus to regional influence. As funding, regulation, and technology align across borders, Indonesia’s fintech players are taking full advantage of ASEAN’s growing fintech network.

The Rise of E-Wallets and Pay-Later Services

At the consumer level, Indonesia’s e-wallet and pay-later services are driving much of this expansion. The country is expected to become the largest “buy now, pay later” (BNPL) market in Southeast Asia by 2025. BNPL e-commerce spending in Indonesia is forecasted to grow 8.7 times from 2020 levels.

This Indonesia Cross-border Fintech Expansion trend is backed by strong user growth. By 2025, Indonesia is projected to add 130 million new e-wallet users — the largest increase in ASEAN. These numbers reflect not just domestic adoption but regional opportunity. As more Indonesians embrace digital payments, their behavior sets standards that ripple across neighboring economies.

In 2023, digital payment penetration in Indonesia reached 83%, showing how fintech is helping achieve broader financial inclusion. E-wallets and BNPL options are giving millions access to digital financial tools that were once out of reach.

Read Also: Indonesia’s Digital Banking Revenue Forecast to Hit USD 8.6B by 2029

ASEAN Leadership Through Innovation

All of these factors, from funding, technology, and user growth, to regional integration, show a clear pattern. Indonesia’s fintech industry isn’t just expanding; it’s shaping how Southeast Asia pays, invests, and manages money. The combination of rapid domestic adoption and cross-border innovation makes Indonesia a fintech leader in ASEAN.

As this Indonesia Cross-border Fintech Expansion continues, businesses and investors looking to understand or enter ASEAN markets can learn from Indonesia’s playbook. For strategic insights and tailored guidance, reach out to Market Research Indonesia, a global consulting firm helping companies navigate digital growth and regional expansion opportunities.