Indonesia’s rice sector is undergoing a major shift. After years of depending on imports, the country is now projecting a 3.5 million ton surplus by the end of 2025. This reflects stronger domestic production, yet exporting that surplus is far from straightforward. Strict trade rules, quality concerns, and fierce global competition highlight the Indonesia rice export challenges shaping the future of this vital commodity.

A History of Dependence on Imports

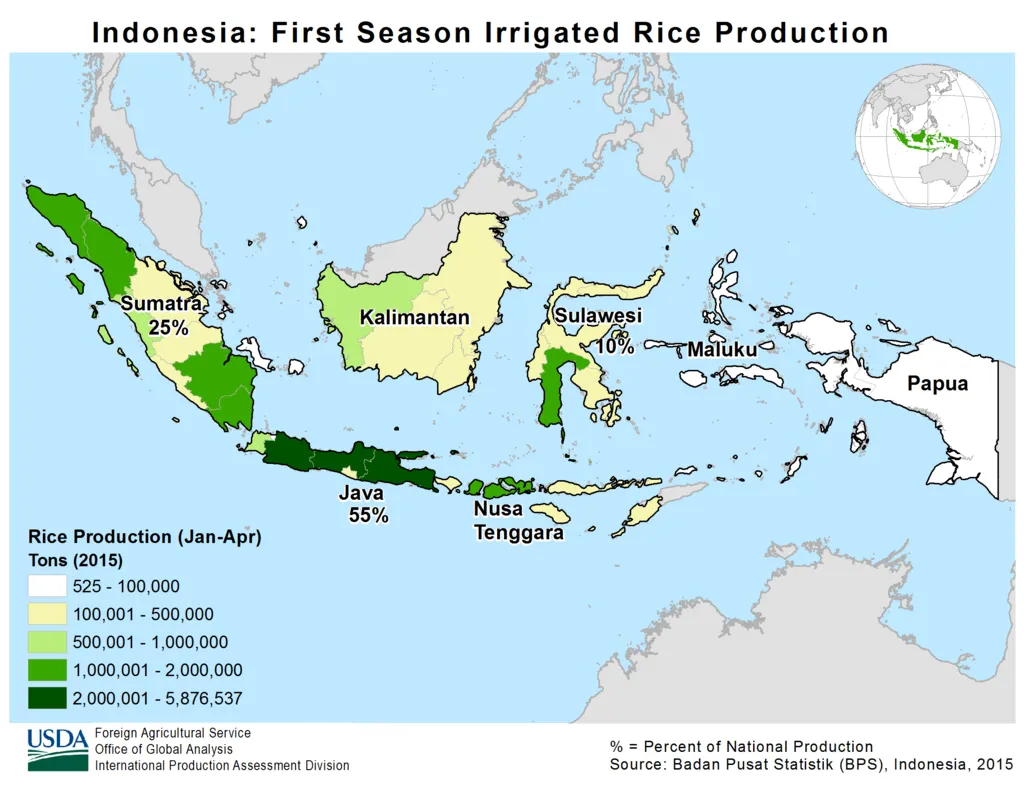

Despite being one of the world’s largest rice producers, Indonesia has often relied on imports to meet domestic needs. Over the past three years, rice imports surged by 309%, with supplies coming mainly from India, Pakistan, Vietnam, Thailand, and Myanmar.

This heavy dependence raised concerns about food security and foreign reliance. In response, the government announced that no rice imports will take place in 2025. Instead, Indonesia is turning to domestic farmers and reserves to meet national demand, signaling a strong push for self-sufficiency.

Indonesia Rice Export Challenges: Surplus Meets New Regulatory Barriers

While the surplus offers export potential, stricter trade regulations are holding growth back. The Ministry of Industry and Trade has introduced tougher rules to prioritize domestic food security. Exporters now face additional checks, including strict limits on volumes leaving the country.

At the same time, the government is boosting national rice reserves. By purchasing from local farmers, it aims to raise reserves to 8 million tons by the end of 2025, with 2.5 million tons earmarked for direct domestic storage. This means that even with surplus stock, much of the rice is being held back for local consumption rather than international sales.

Quality Control Adds Another Layer to Indonesia Rice Export Challenges

Beyond trade restrictions, quality control standards pose further hurdles. Officials want to ensure that rice exports meet international benchmarks while protecting domestic supplies. This has slowed approvals for exporters and created uncertainty for traders seeking long-term contracts abroad.

Read Also: Tech-Driven Indonesia Agricultural Sector Innovation

Between January and May 2025, Indonesia’s State Logistics Agency (Bulog) absorbed 1.87 million tons of rice into local distribution channels. While this safeguards domestic needs, it leaves less flexibility for export activity.

Global Competition Intensifies

Even if Indonesia navigates regulations, it faces steep global competition. India, the world’s largest rice exporter, continues to expand shipments while cutting prices. This makes it harder for Indonesian rice to compete in international markets where buyers are highly price-sensitive.

Falling global rice prices further squeeze potential margins, especially for exporters dealing with added domestic restrictions. For Indonesia, the challenge is balancing affordable domestic supply with competitive global pricing—a difficult equation under current conditions.

Read Also: Strengthening Exports with Indonesia Blockchain Traceability

The Road Ahead for Indonesia Rice Export Challenges

The shift toward self-sufficiency and stricter regulation reflects valid national concerns. However, these measures also risk limiting Indonesia’s role in global rice trade at a time when it finally has a production surplus to offer. If managed strategically, Indonesia could still leverage its surplus to build a stable export market, particularly in niche segments where quality and sustainability are valued over price alone. But without adjustments, the combination of regulations, reserve absorption, and international competition may continue to hold back export growth.

In short, Indonesia rice export challenges are rooted not just in production, but in balancing domestic security with international opportunity.