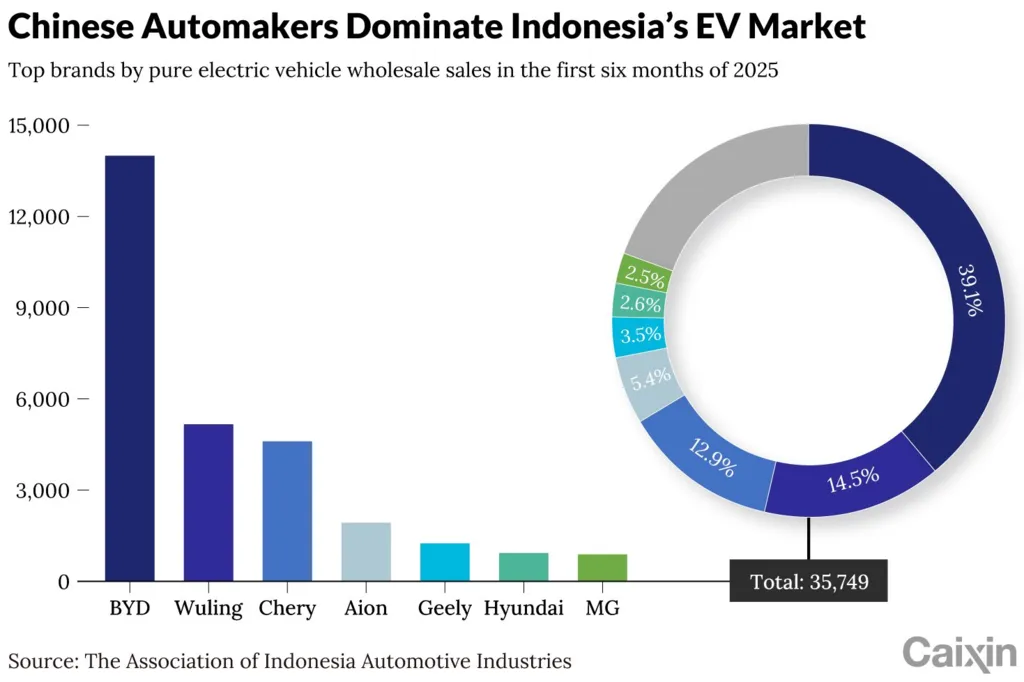

Indonesia’s electric vehicle (EV) sector is growing at a pace few expected. In just the first half of 2025, EV sales jumped 267% compared to the previous year, reaching 35,749 units. The surge is overwhelmingly powered by Chinese automakers, who account for a stunning 93% of these sales. This rapid Indonesia's Chinese EV Influx is reshaping the country’s automotive landscape, fueled by government incentives, local investment, and consumer demand for affordable, advanced EVs.

Indonesia's Chinese EV Influx: Dominance of Chinese EV Brands

Chinese brands are not just present in Indonesia’s EV market—they dominate it. Between January and July 2025, total EV sales reached 42,178 units, almost matching the 43,188 units sold in all of 2024.

Among them, BYD leads the pack, selling 16,427 units in the first seven months alone. Its models such as the Denza D9, M6, and Sealion 7 each recorded over a thousand sales in March 2025, showing strong consumer uptake. Following BYD, Wuling sold 6,210 units, and Chery reached 5,196 units over the same period. Together, these companies show how fast Chinese automakers are seizing Indonesia’s growing EV demand.

Massive Investments to Build Local Capacity

Behind this market domination is a wave of investment. Seven Chinese automakers have poured around USD 9.25 billion (IDR 150 trillion) into Indonesia between 2024 and March 2025. Their combined annual production capacity goal is 280,000 vehicles, a scale that ensures long-term supply and lowers dependence on imports.

These commitments are not limited to car assembly. Chinese battery giants such as CATL and BTR New Material are also establishing plants in Indonesia. With access to the country’s rich nickel reserves, these players are reducing battery costs through local sourcing, which in turn makes EVs more affordable for Indonesian consumers.

Read Also: Explore the Indonesia EV Battery Downstream Project for Sustainable Innovation

Government Policies Driving Indonesia's Chinese EV Influx

Indonesia’s government has been instrumental in attracting this surge of investment. Policies incentivizing EV adoption—through tax breaks, subsidies, and infrastructure support—make it attractive for foreign companies to establish a local presence.

At the same time, Jakarta’s push to develop a domestic EV ecosystem aligns perfectly with China’s ability to supply cost-competitive EVs. The result is a fast-growing partnership where foreign automakers benefit from favorable policies, and Indonesia accelerates its shift toward clean mobility.

Read Also: Indonesia EV Policy Drives $14B Clean Tech Bet, and More

Technology, Pricing, and Market Fit

One reason Chinese brands have succeeded so quickly is their ability to balance competitive pricing with strong technology offerings. Many models sold in Indonesia deliver long driving ranges and fast charging capabilities at prices below those of Western rivals.

This makes them well-suited for Indonesian consumers, who are sensitive to price but eager for modern, sustainable alternatives to combustion vehicles. The alignment of affordability, innovation, and policy support has created the perfect environment for the Indonesia's Chinese EV Influx.

The Implications of Indonesia's Chinese EV Influx for the Future

The current trajectory suggests that EV sales in 2025 could double compared to 2024, with Chinese brands holding their lead. Local production, supported by billions in investment, ensures that these companies are not just short-term entrants but long-term players shaping Indonesia’s auto industry.

However, this dominance also raises questions. Can domestic Indonesian brands compete with the scale and efficiency of Chinese automakers? How will Western automakers respond to the market shift? For now, Chinese companies are firmly ahead, and Indonesia's Chinese EV Influx shows no signs of slowing.

FAQs

1. How much of Indonesia’s EV market is controlled by Chinese brands?

In early 2025, Chinese automakers accounted for 93% of EV sales in Indonesia.

2. Which Chinese EV brand leads sales in Indonesia?

BYD leads, selling over 16,000 units in the first seven months of 2025.

3. How much have Chinese EV makers invested in Indonesia?

Around USD 9.25 billion has been invested since 2024, targeting large-scale production.

4. Why is Indonesia attractive to EV makers?

Government incentives and abundant nickel reserves make it ideal for EV and battery production.

5. Will EV sales in Indonesia keep growing?

Yes. With policies and investments in place, EV sales are expected to outpace 2024 totals significantly in 2025.